Master Bear & Bull Markets: Share Trading Educator’s Guide

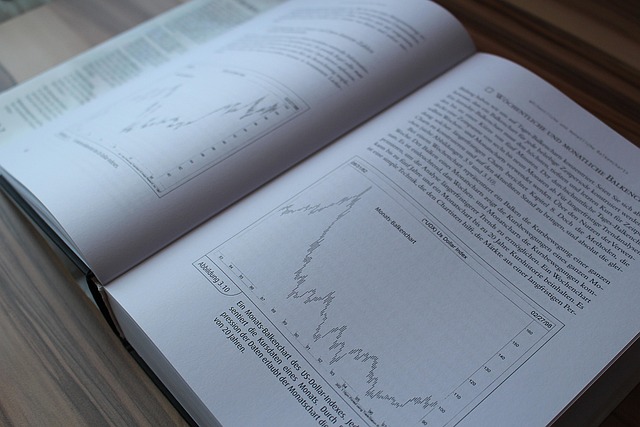

Skilled share trading educators are vital for guiding investors through bear and bull markets with strategic approaches. In downturns, diversification and long-term value investing protect portfolios, while bullish periods demand aggressive grow…….