A share trading educator emphasizes that understanding trading psychology is crucial for success, alongside chart interpretation. By recognizing and managing emotional biases like fear and greed, traders can make rational decisions based on analysis rather than instinct. This involves identifying personal emotional triggers through journaling, setting clear trading rules, using stop-loss orders, taking breaks during high-emotion periods, and establishing consistent pre-trade routines. Objectivity is key, achieved through strategies such as technical analysis-based entry/exit rules, meditation, exercise, and structured sleep. Emotional control, developed with discipline and mindfulness practices, helps avoid impulsive decisions driven by fear or greed, leading to consistent success in share trading and ultimately achieving wealth within.

Emotional decisions can be costly in the volatile world of share trading. To navigate this landscape successfully, understanding and managing your psychology is crucial. This article delves into the intricacies of trading psychology, equipping you with essential tools to avoid emotional pitfalls. From identifying triggers to implementing strategies for maintaining objectivity, we explore practical tips from leading share trading educators emphasizing the ‘wealth within’ approach – fostering rational decisions for long-term success.

- Understanding Trading Psychology: The Key to Rational Decisions

- Identifying and Managing Emotional Triggers in Share Trading

- Strategies for Maintaining Objectivity: A Wealth Within Approach

- Practical Tips from Trading Educators: Avoiding Emotional Pitfalls

Understanding Trading Psychology: The Key to Rational Decisions

Understanding Trading Psychology: The Key to Rational Decisions

In the dynamic world of share trading, a crucial aspect often overlooked is the power of psychology. A skilled share trading educator knows that mastering trading psychology is not just about making sense of charts and graphs; it’s about understanding the human mind in times of financial decision-making. This field delves into the emotions, biases, and cognitive processes that influence traders’ choices. By recognizing these psychological factors, investors can avoid letting impulsive decisions cloud their judgment, ultimately leading to wealth within.

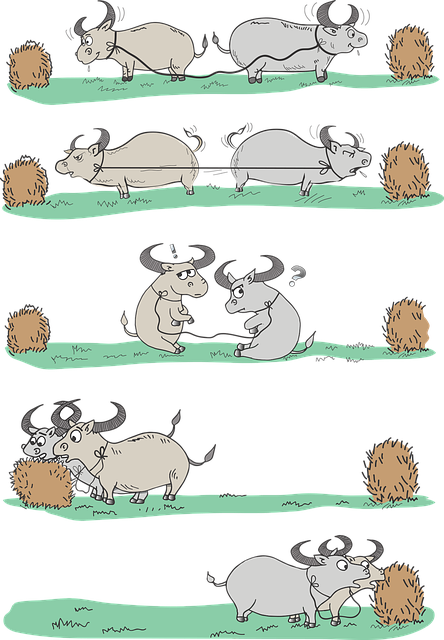

Traders often face a constant battle between their rational minds and emotional responses. Fear, greed, and confidence—often referred to as the “trifecta of trading”—can distort one’s perspective, causing them to make hasty decisions. A deep dive into trading psychology equips individuals with strategies to stay calm under pressure, recognize these emotions, and make informed choices based on analysis rather than instinct. This approach ensures that their investment strategies are guided by rationality rather than fleeting feelings.

Identifying and Managing Emotional Triggers in Share Trading

Emotional triggers can significantly impact share trading decisions, often leading to impulsive moves that traders later regret. As a share trading educator, it’s crucial to identify and manage these triggers to avoid emotional decisions. Traders should be aware of their unique emotional responses to market fluctuations, news events, or specific stocks. Journaling can help in recognizing patterns; for instance, tracking reactions to significant losses or gains can reveal hidden fears or greeds.

Once identified, managing emotional triggers involves strategies such as setting clear trading rules and adhering to them, using stop-loss orders to limit potential losses, and taking breaks when emotions run high. A share trading educator might also recommend developing a consistent pre-trade routine to foster mental clarity. By maintaining a level head, traders can make more rational decisions, increasing the likelihood of achieving wealth within the market rather than letting emotions dictate their moves.

Strategies for Maintaining Objectivity: A Wealth Within Approach

Maintaining objectivity is a cornerstone in navigating the volatile world of share trading, and it’s here that many educators agree a profound shift occurs—from emotional reactivity to calculated decision-making. For traders, this means embracing strategies that foster a ‘Wealth Within’ mindset, allowing them to detach from fleeting market sentiments. One such strategy involves setting clear, predefined rules for entry and exit points, based on sound technical analysis rather than impulsive reactions. By establishing these boundaries, traders can ensure their choices are guided by rational thought rather than immediate emotions.

Additionally, cultivating a routine that promotes mental clarity can significantly enhance objectivity. This could involve meditation practices to calm the mind, regular physical activity to reduce stress, or even simple habits like maintaining a structured sleep schedule. These routines create a sense of equilibrium, enabling traders to approach their screens with a clear head and a level-headed perspective—essential tools for making informed decisions in the fast-paced environment of share trading, guided by the principles of a ‘Wealth Within’ philosophy.

Practical Tips from Trading Educators: Avoiding Emotional Pitfalls

When delving into share trading, emotional control is a crucial skill to master. Many aspiring traders often fall into the trap of making impulsive decisions driven by fear or greed. Trading educators emphasize that mastering one’s emotions is akin to unlocking hidden wealth within oneself. They suggest practical techniques like taking breaks when feelings intensify, setting clear goals, and practicing mindfulness to stay grounded during market volatility.

These educators recommend developing a disciplined approach, where each trade is executed based on well-researched strategies rather than immediate reactions. By adopting these practices, traders can avoid common emotional pitfalls that often lead to poor decision-making. This mental fortitude becomes a key differentiator in navigating the complexities of financial markets and ultimately, achieving consistent success and growing wealth.

By studying trading psychology and adopting strategies like the ‘wealth within’ approach, traders can significantly enhance their decision-making processes. Understanding emotional triggers and maintaining objectivity are essential skills for navigating the complexities of share trading. Following practical tips from experienced educators can help traders avoid common emotional pitfalls, leading to more rational and successful decisions in the long run.